A leading member of the New Patriotic Party (NPP), P.K. Sarpong, has explained why the Ghanaian cedi is performing better against the US dollar.

In a Facebook post on Monday, 5th May, 2025, he listed key reasons for the cedi’s current strength.

According to Sarpong, there are two main reasons. First, he said the US dollar itself is losing strength because of what he called the “Triple T” – Trump Trade Threats. He explained that global uncertainties caused by former US President Donald Trump’s trade-related policies are affecting the value of the US dollar, making other currencies, including the cedi, look stronger in comparison.

Secondly, Sarpong said Ghana’s foreign reserves are rising again. He pointed out that the Bank of Ghana’s reserves were around $9.9 billion in January 2022, and although the reserves dropped during the Russia-Ukraine war, they are now going back up. He noted that the cedi enjoyed one of its most stable periods between 2017 and 2022 when the reserves were strong.

In the last quarter of 2024, the cedi was trading at almost GHS17 to $1. However, after the Bank of Ghana pumped $2.8 billion into the economy, the exchange rate improved quickly. By 7th January 2025, one dollar was being exchanged for GHS14.53.

Sarpong also credited the Bank of Ghana’s gold purchase programme as another reason the reserves are increasing. This, he said, gives the central bank more power to manage the foreign exchange market.

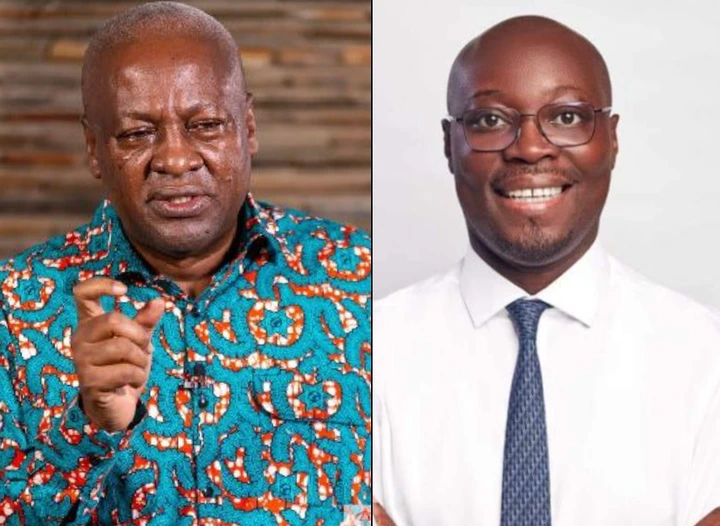

He rejected claims that the recent stability of the cedi is due to the current government’s fiscal policies. According to him, it is not possible for President Mahama’s economic plan, which only started in April 2025, to have such a quick effect on the cedi. He believes the NDC’s budget has not yet had time to make any real impact.

In his view, the cedi is doing well because of market forces and decisions made by the central bank and not because of any new policies from the current administration.